Getting The Hiring Accountants To Work

Table of ContentsHiring Accountants for DummiesOur Hiring Accountants PDFsThe Hiring Accountants PDFsHow Hiring Accountants can Save You Time, Stress, and Money.Hiring Accountants Can Be Fun For Anyone

At some time, you require to select a bookkeeping system to use in your business. When your company is growing swiftly, it's wise to have the insight of a person that comprehends monetary projecting for establishing the finest strategy.Individuals are not required by regulation to maintain monetary books and documents (services are), yet refraining from doing this can be a costly blunder from a monetary and tax obligation perspective. Your checking account and bank card declarations might be incorrect and you may not find this until it's far too late to make corrections.

Our Hiring Accountants Ideas

Whether you require an accountant will certainly most likely depend on a couple of variables, consisting of exactly how challenging your taxes are to file and the number of accounts you have to take care of. This is a person that has training (and likely a college level) in accounting and can take care of bookkeeping duties. The per hour price, which once more relies on place, job description, and expertise, for a self-employed accountant is regarding $35 per hour usually yet can be significantly a lot more, align to $125 per hour.

While a CPA can give accounting solutions, this professional might be also expensive for the job. Hourly charges for CPAs can run around $38 per hour to begin and raise from there. (The majority of CPAs do not deal with accounting solutions directly however utilize a staff member in their firm (e (Hiring Accountants).g., a bookkeeper) for this job.) For the jobs described at the beginning, an individual bookkeeper is what you'll require.

It synchronizes with your bank account to simplify your personal finances. You can function with a bookkeeper to assist you get started with your personal audit.

Not known Details About Hiring Accountants

You make a decision to manage your personal bookkeeping, be certain to separate this from accounting for any kind of business you have.

As tax obligation season techniques, people and businesses are encountered with the perennial concern: Should I tackle my tax obligations alone or hire a professional accounting professional? While the attraction of conserving money by doing it yourself might be appealing, there are engaging factors to take into consideration the competence of a certified accountant. Here why not try here are the top reasons hiring an accountant could be a smart investment contrasted to browsing the complicated globe of taxes on your very own.

Tax obligations are intricate and ever-changing, and a skilled accounting professional stays abreast of these modifications. Their experience ensures that you make the most of all offered reductions and credit scores, inevitably optimizing your potential tax cost savings. Completing your own tax obligations can be a time-consuming and labor-intensive process. Hiring an accountant liberates your time, allowing you to focus on your personal or business tasks.

Tax errors can result in significant consequences, consisting of audits, penalties, and penalties. Accounting professionals are educated to minimize the threat of blunders and are fluent in identifying prospective warnings that can set off an audit. Their interest to information helps protect against pricey mistakes that might occur from overlooking reductions, miscalculations, or incorrect paperwork.

Indicators on Hiring Accountants You Should Know

They can encourage on approaches to reduce your tax obligation obligation and optimize your economic placement. DIY filers might miss out on out on potential savings by not completely recognizing the complexities of the tax obligation code. Among the abstract advantages Visit Your URL of hiring an accounting professional is the tranquility of mind that features knowing your taxes are in qualified hands.

Their proficiency in this area can cause substantial cost savings, ultimately increasing your bottom line. For more about your money department's roles, responsibilities, and spending power, see our article on the difference between Accounting Supervisor vs. Controller. With frequently changing monetary guidelines, remaining compliant can be an obstacle. This is where an additional among the major accountancy supervisor benefits comes in.

Sep 9 2024 In the world of business, numbers narrate. They show a business's monetary health, overview decision-making, and shape critical preparation (Hiring Accountants). While lots of local business owner could really feel comfortable handling their financial resources separately, employing a professional accounting professional can use considerable benefits that add to monetary growth and stability

The smart Trick of Hiring Accountants That Nobody is Discussing

For more experienced accounting professionals, the salary will be greater at $97,530. Every business requires the services of an accountant, from economic reporting to tax obligation declaring.

Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Seth Green Then & Now!

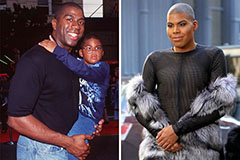

Seth Green Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!